TL;DR:

- U.S. retirees living abroad must pay U.S. taxes on Social Security and global income, including pensions.

- Tax treaties may prevent double taxation; countries like Canada and the UK have agreements with the U.S.

- The Foreign Earned Income Exclusion generally doesn’t apply to retirement income.

- Retirees must report foreign accounts to comply with FATCA and submit FBAR if accounts exceed $10,000.

- Solutions for dual taxation include using foreign tax credits.

- Tax treaties can offer reduced rates on pensions and necessitate filing appropriate forms.

- U.S. citizens abroad remain subject to U.S. tax laws.

- Owning foreign property involves reporting to the IRS, potential double taxation, and currency exchange impact.

- Consulting a tax advisor can help manage expatriate tax obligations effectively.

As U.S retirees plan their golden years in foreign lands, one question nags them: Are their Social Security benefits taxed abroad? I’m here to break it down for you. Navigating these waters involves understanding exemptions, IRS rules, and implications for your dual pensions. Whether exploring tax treaties or foreign bank reporting, let’s make sense of tax responsibilities and find ways to make the most of your overseas retirement.

Tax Implications: Do U.S. Retirees Abroad Pay Taxes on Social Security?

You might wonder, do you pay taxes on Social Security if you live abroad? The answer: Yes, you do. The IRS taxes Social Security benefits no matter where you live. If you are a U.S. retiree enjoying life outside the country, your Social Security income is still taxable. Staying connected with the IRS is part of living abroad as a U.S. citizen.

Some countries have tax agreements with the United States. These agreements help retirees avoid paying local taxes on U.S. Social Security. It is good to check if your new home country has these agreements in place. This could save you from extra taxes on the same income.

The United States has agreements with countries like Canada, Germany, and the UK. These agreements often focus on avoiding double taxation, which is paying taxes twice on the same income. Double-check if your new home has a treaty with the U.S. It can help clarify tax duties.

IRS rules are clear: Social Security benefits are taxable, no matter where you live. Whether you receive checks in the U.S. or abroad, Uncle Sam wants his cut. You need to follow U.S. tax laws to avoid penalties.

If you get pensions from both the U.S. and your new home country, think carefully. These dual benefits can affect tax outcomes. You might face complicated tax situations if you receive income from two countries. Understanding the tax laws in each place will be key to managing your finances.

Planning helps avoid surprises. Talk with a tax expert who knows about expatriation. They can guide you in sorting through these complex tax rules. Look for someone who understands both U.S. and foreign tax systems.

For more on how Social Security works while living abroad, check out the Social Security Administration website. This source offers reliable updates and guidance, helping retirees understand their benefits.

How Is Foreign Income Taxed for Retirees?

If you retire abroad, do you have to pay U.S. taxes? Yes, you do. The U.S. taxes its citizens on worldwide income, even if you live overseas. This includes pensions, investments, and any other income you may have.

The U.S. tax system treats money earned outside the country as foreign income. It means you must report it on your U.S. tax return. Even though you live abroad, you might benefit from the Foreign Earned Income Exclusion (FEIE). This lets you exclude up to a set amount of your foreign earned income from U.S. tax. However, this doesn’t usually cover retirement income from pensions or investments.

What about other foreign income you may have? Well, you must report it to the IRS. This includes interest, dividends, and rental income from properties. Staying transparent with these reports can help avoid problems later.

You might wonder, “Can I get taxed twice?” Yes, it’s possible. Double taxation can occur when both the U.S. and the foreign country tax the same income.

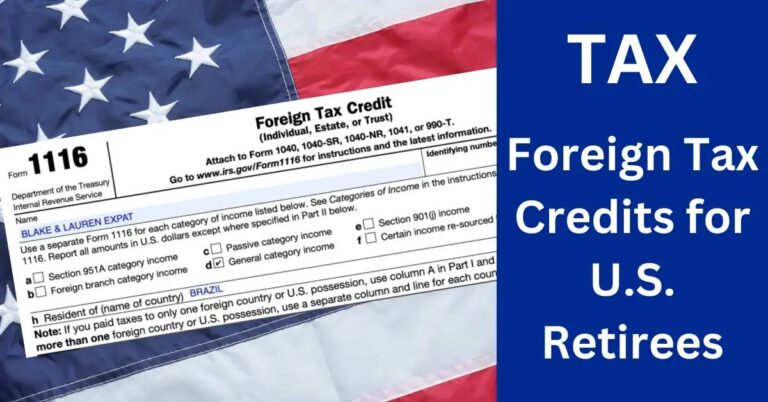

Fortunately, there are solutions. Consider using foreign tax credits. These credits can offset taxes paid to another country, reducing your U.S. tax bill. It means you don’t pay tax on the same income twice.

To wrap it up, understanding foreign income taxation for retirees involves knowing the rules and benefits like FEIE. Watch for double taxation. Using strategies like tax credits can help ease the burden. Consult with a tax advisor if you’re planning to retire abroad. They can guide you in managing your expatriate tax obligations effectively.

Do U.S. Retirees Need to Report Foreign Accounts?

Have you ever wondered if U.S. retirees need to report foreign accounts? The answer is yes. Retirees must report foreign accounts to meet the FATCA and IRS requirements for expats. FATCA, or the Foreign Account Tax Compliance Act, impacts retirees living abroad. It aims to prevent tax evasion through foreign accounts. Now, why is this important? It ensures Uncle Sam knows about your overseas accounts, helping maintain tax compliance.

Under FATCA, the IRS requires retirees to report foreign bank accounts if the total exceeds reported thresholds. This involves the FBAR, which stands for Foreign Bank Account Report. Do you have accounts reaching or exceeding $10,000 at any time during the year? Then you need to submit the FBAR. This reporting is separate from your regular tax return filing, which is important to keep in mind.

What are the penalties for not following these rules? They’re serious. Failing to report your foreign accounts on time can lead to significant fines. Penalties can be as pointed as $10,000 for each violation. The financial pressure is heavy, so it is vital to avoid non-compliance.

Are you concerned about how to correct past failures in reporting foreign accounts? The IRS offers streamlined foreign offshore procedures to help. This option allows for voluntary disclosure to fix previous non-compliance. It is useful if past mistakes occurred due to misunderstanding or oversight. But, how does it work? It involves submitting amended tax returns and FBARs, along with certification that non-compliance was not intentional.

How much overseas income is exempt from U.S. taxes? There is a catch here. The U.S. taxes all income earned abroad unless exceptions apply. These exceptions might involve the Foreign Earned Income Exclusion or use of foreign tax credits. Consequently, understanding these tools is essential, ensuring you benefit fully and avoid double taxation. Planning and knowledge are your best allies in navigating this!

Can U.S. Retirees Utilize Tax Treaties?

Tax treaties can be very helpful for U.S. retirees living abroad. They are agreements between two countries to resolve issues of double taxation. These treaties aim to dictate which country gets to tax different types of income. Without these treaties, retirees might face double taxation—paying taxes both to the U.S. and the country they live in.

Many countries have such treaties with the U.S., offering various tax treaty benefits. These benefits can include reduced tax rates on pensions, exemption on certain income types, or even credit for taxes paid abroad. To get these benefits, you need to file the proper forms with the IRS and the tax office in your new country.

You might wonder, “What countries don’t tax US pensions?” Well, it varies. Some countries offer better deals for retirees than others. One example is Portugal, which has a favorable tax system for foreign pensions. Keep in mind, the benefits you get depend on the country’s rules and your personal situation.

But how do tax treaties work with U.S. citizenship and taxes? Even if you live abroad, the U.S. still expects you to report your global income. Tax treaties help lessen this burden. For example, if you live in a country with a treaty and receive a pension there, the treaty might mean that only one of the two countries taxes your pension.

For retirees who hold dual citizenship, treaties can be even more complex but potentially beneficial. Dual citizenship might let you maximize treaty benefits if your other country’s tax laws offer additional advantages. But this requires careful planning to ensure you comply with both countries’ laws.

To navigate this complexity, consider consulting a tax professional who understands both U.S. and local laws. They can help you make sure you’re using all possible benefits and reducing your tax bills legally.

What Is the Tax Treatment for U.S. Pensions Abroad?

Do you pay tax on pensions if you live abroad? Yes, the U.S. taxes your pension. Even when living abroad, American citizens must report and pay taxes on their global income, including pensions. The U.S. taxes pensions partly because citizens are taxed on worldwide income, regardless of residency.

When it comes to 401(k) and IRA withdrawals abroad, they are often fully taxable. This means the same taxation rules apply abroad as if you lived in the U.S. Both 401(k) and IRA withdrawals can raise your taxable income, affecting your tax bracket.

What are the rules in other countries? Well, foreign countries may also tax your pension. It’s important to know each country’s specific taxation rules on U.S. pensions. Some places might have agreements to reduce or remove double taxation, but it varies. You should check countries’ tax treaties to clarify any relief offered.

Country-specific laws can greatly impact your pension taxes. Some countries tax foreign pensions while others do not. Research each nation’s income tax laws before moving there. It helps to consult with a financial advisor familiar with international issues.

Planning matters when living abroad with pensions. Consider tax-efficient withdrawal strategies. For example, should you spread withdrawals over a few years? This may help manage tax rates. Structured withdrawals can help keep taxes lower and save you money.

Understanding these principles and rules is key to effective financial planning abroad. Retirees must plan wisely to keep more of their hard-earned money. Start by staying informed and seeking personalized advice. With good planning, you can enjoy retirement both abroad and at home.

How Can Retirees Minimize Tax Liabilities?

When moving abroad, retirees can explore tax-free opportunities. While no country is completely tax-free, some have favorable tax policies for retirees. Consider Costa Rica, Panama, and Portugal as options, as they offer lenient tax treatments.

Minimizing taxes while living abroad starts with knowing legal tax strategies. Retirees can use tax deductions offered to expatriates. One key deduction is the Foreign Earned Income Exclusion, which can help reduce taxable income. However, this only applies if you have earned income abroad, not retirement income.

When planning, structuring investments is important for tax efficiency. Municipal bonds, for example, can provide tax-free interest income in the U.S. Utilizing tax-efficient investments can lower your tax obligations both in the U.S. and abroad. Be aware that investments can be taxed differently in your new country, so it’s wise to consult a financial advisor familiar with local laws.

Residency location plays a significant role in tax savings. Some countries have tax incentives to attract retirees. Places like Panama have special programs for retirees, offering tax relief benefits. When choosing a location, ensure your residency doesn’t create double taxation. Investigate if the country has a tax treaty with the U.S. to avoid this.

By being mindful of these strategies, retirees can better manage their tax situation. Always stay informed about changes in tax laws, both in the U.S. and your new home country. Consulting with an international tax expert can help navigate the complexities and make the most of your retirement abroad.

What Are the Implications of U.S. Tax Residency Rules?

U.S. tax residency rules determine if you must pay taxes to the U.S. even when abroad. Understanding the criteria for tax residency is crucial for any U.S. retiree who plans to live overseas. If you are a U.S. citizen, you remain subject to U.S. tax laws no matter where you live. However, your residency status can affect the specific taxes you owe.

How long can a retired U.S. citizen stay out of the country? The U.S. does not limit how long you can stay abroad, but tax duties continue. You need to know that even when you stay outside the U.S. for the whole year, your tax responsibilities don’t vanish. The U.S. taxes its citizens based on their worldwide income, so your foreign income may also be taxed by the U.S.

Tax residency status impacts your obligations and can complicate your finances. For instance, if you’re a dual citizen, having citizenship in another country might offer some opportunities and challenges in tax planning. You could face dual taxation where both the U.S. and another country tax the same income. Thankfully, the U.S. has many tax treaties which might alleviate this burden, but these are not comprehensive solutions.

If you stay extended periods abroad, you should be mindful of your tax strategies. Being aware of your tax residency status can help you navigate your tax obligations better. Long stays out of the U.S. can be exciting, but if not planned correctly, they come with severe tax implications.

Knowing about the specific tax rules concerning residency may prevent surprises when tax season comes. Each retiree should assess how their country relocation impacts their finances. Being proactive can simplify your tax duties and give you peace of mind while enjoying your time out of the U.S. Always consider talking to a tax advisor for tailored advice to ensure compliance and optimize tax responsibilities.

How Does Property Ownership Affect Taxes for Retirees?

Owning a home overseas brings tax considerations. When buying or selling property abroad, tax rules apply. For U.S. retirees, these usually depend on local laws. In some places, property gains get taxed heavily. When selling your home, you may pay a capital gains tax to the foreign country. You would also report this to the IRS. This could mean paying U.S. capital gains taxes too.

Now, what about exchange rates? They matter a lot. Exchange rates can change the value of gains or losses from property. Say the U.S. dollar falls. This makes your foreign gains look larger in dollars. The IRS sees that larger amount, which could mean higher taxes. Keep an eye on rates. They can turn small gains into big tax bills.

How about estate tax planning? It’s crucial for expats owning property. Estate planning ensures your assets go to the right people. Some countries have steep estate taxes. U.S. estate taxes might apply if your worldwide estate exceeds a certain value. Make sure to plan ahead. This prevents loss of value to taxes when passing on property.

Reporting is another big piece. The IRS needs full details of foreign properties. This means reporting on forms like the FBAR. Missing these reports could lead to penalties. Always declare your overseas assets. It helps avoid costly mistakes. The IRS wants to know about all your foreign dealings, and so do other countries.

In short, property ownership abroad has many tax angles. It affects how much you owe in ways you might not expect. Be ready to handle these parts. For more detailed guidance, visit the IRS website. It offers resources on international taxation and property issues. Stay informed to maximize your benefits and fulfill all legal duties.

Conclusion

Living abroad can complicate your taxes, but understanding the rules helps. Some countries exempt U.S. retirees’ Social Security, while others don’t. Know the IRS requirements and consider dual pensions’ impact. Foreign income and accounts require careful reporting to avoid penalties. Tax treaties can ease double taxation, and planning boosts benefits. With the right strategies, you can minimize tax liabilities while enjoying retirement abroad. Explore property tax implications too, ensuring you stay informed. Remember, good planning secures tax-efficient living, letting you focus on enjoying life in your new home.