TL;DR:

- U.S. citizens/residents must report foreign properties and pay U.S. taxes on them; non-residents have fewer obligations.

- Foreign property expenses like mortgage interest and property taxes may be deductible.

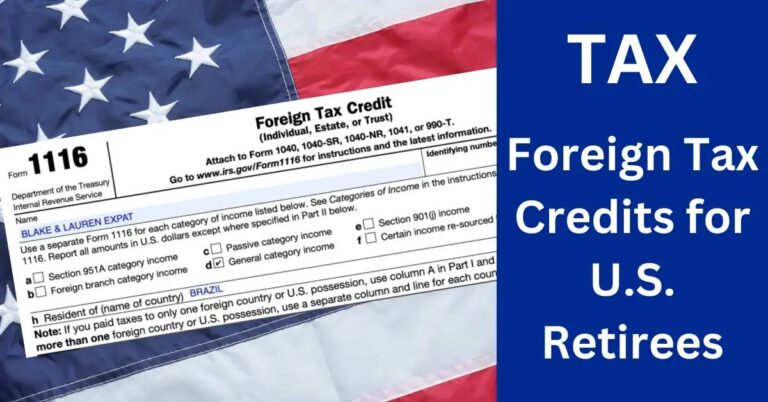

- Tax treaties and the Foreign Tax Credit can prevent double taxation.

- Selling foreign property involves capital gains tax; require IRS reporting even with no gain.

- Rental income from foreign properties is taxable; deductions are available for expenses.

- Deadlines are crucial; typically April 15 for U.S. taxes.

- Tax benefits include deductions, depreciation, and credits, reducing double taxation.

- Expatriates face unique challenges; consider professional advice for effective tax planning.

- Detailed record-keeping is essential for compliance and optimizing tax savings.

Navigating the world of foreign real estate tax doesn't have to be daunting. As a global nomad, understanding your tax responsibilities for properties abroad is crucial. Are you aware of the taxes you'll face on your overseas property? What about deductions and credits you might miss? In this guide, I'll help you explore tax-friendly strategies and uncover the secrets to minimizing your liabilities while ensuring compliance. Dive in to secure your peace of mind.

How Are Foreign Real Estate Taxes Applied?

Different countries have unique foreign real estate taxes. It's easy to get mixed up. In the U.S., you must report foreign properties. You might have to pay taxes on these properties. Yes, you have to pay U.S. taxes on foreign property. Even if your property isn't in the U.S., it's taxable.

Foreign property taxes can be deducted. The IRS allows deductions but with limits. You need to know which expenses qualify. For example, mortgage interest or property taxes often qualify. You should keep detailed records for these deductions.

Avoiding taxes legally is possible, but know the rules. Use tax treaties between countries. These treaties prevent double taxation—where you pay twice on the same income. You can also use the Foreign Tax Credit. This credit lessens your U.S. taxes for taxes paid to another country. However, strict requirements must be met to use it.

Your residential status affects your foreign property taxes. U.S. citizens and residents need to report almost all foreign property. Non-residents have fewer reporting obligations. This can affect tax liabilities, such as which deductions you can claim.

Each country has property tax regulations, and you must comply. In many places, you’ll pay annual property taxes based on value. Penalties for missing payments can be serious. Understand each country's laws to avoid fines and unnecessary costs.

Efficient tax planning includes knowing deductions. Expense deductions differ country to country. Research applicable deductions in your property’s location. Plan and analyze each tax year to optimize savings. Seek professional help if it's too complex. Most find professional help invaluable in planning.

Tax planning is complex but doable. Knowing U.S. and foreign tax laws can save you money and stress. Wise tax planning can mean better savings and compliance. Trustworthy professionals can be your guide in this journey.

What are the implications of selling foreign property?

Selling a foreign property can come with important tax implications. When you sell, you might have to pay capital gains tax on foreign property. But how do you calculate this? You take the selling price and subtract what you paid for the property, including any improvements. The result is your capital gain, which is subject to tax.

One question many ask is, "Do I have to report the sale of foreign property to the IRS?" Yes, you do. The IRS requires reporting if you are a U.S. citizen or resident. Even if you made no gain, proper reporting is necessary to avoid penalties.

Are you wondering how to avoid capital gains tax on foreign property? While there's no magic way to avoid it outright, you can use strategies to reduce it. For example, if your country has a tax treaty with the U.S., that might help lower your tax bill. Using tax credits from the foreign country can also offset your U.S. tax. Always check under the specifics of the tax treaty between the U.S. and the foreign country.

Expatriates face unique challenges when selling real estate abroad. Cross-border tax obligations make it essential to know both U.S. and foreign tax rules. Ignoring either one can lead to overpayment or legal troubles.

Understanding the impact of tax treaties on foreign property sales is crucial. Tax treaties can prevent double taxation on your capital gains. They outline which country has the right to tax the sale and how much credit you might receive.

Real estate tax implications for expats can be complex. Each country's laws can differ. Always consult with a tax professional who understands international tax to ensure compliance.

How Do Rental Incomes from Foreign Properties Affect Your Taxes?

When you own foreign property and earn rental income, you must report it. The IRS sees your foreign earnings as taxable, just like any other income. Even if you don't bring the money back to the US, you need to include it in your tax return. Ignoring this could lead to penalties, so it's essential to comply.

You may wonder about deductions. Yes, foreign real estate expenses can be deductible. This includes costs like repairs, property management fees, and even mortgage interest. You can also deduce property depreciation over a standard period. This means you claim a decrease in property value due to wear and tear.

Strategic planning is key to optimizing your rental income. This involves timing your expenses and understanding tax treaties with the country where your property is located. Tax treaties can prevent double taxation, where you pay the same tax twice in different countries.

Deadlines for filing taxes on foreign income differ. It's crucial to know these dates to avoid late fees. Usually, your tax return, with all foreign incomes reported, is due by April 15. Sometimes, extensions are possible, but it's best to prepare early.

An audit is when the IRS checks your returns closely. Foreign properties can raise audit risks due to complex rules. Keeping good records of income and deductions can help you handle any audits without stress. Planning and accuracy are vital to lower these risks.

In short, know the rules, deduct what you can, and plan wisely. This approach can make a significant difference in how foreign rental income impacts your taxes.

What are the tax benefits and deductions available for foreign real estate investors?

You may wonder, "Are foreign real estate taxes deductible?" Yes, they are deductible, but there are specifics. The IRS allows some deductions, based on certain criteria. For instance, if you rent out your foreign property, you can deduct certain expenses. These include mortgage interest and maintenance costs. It's important to note, only necessary and ordinary expenses are deductible.

Now, let's talk about depreciation. Depreciation can be your friend in reducing taxable income on foreign properties. You can claim depreciation by spreading the cost of your property over time. This is typically over 30 years for residential property. However, keep records detailed and accurate for IRS requirements.

Tax treaties can help you reduce tax burdens on foreign properties. These treaties prevent double taxation, meaning you won't pay tax twice on the same income. Always check if your country has a treaty with the property location. In case of confusion, consult with a tax expert. Understanding each treaty's specifics is crucial for maximum benefit.

You might also ask, "What role do tax credits play?" Tax credits are essential for reducing double taxation. These credits can lower your US tax bill on income taxed abroad. This is significant if you earn rental income from your property.

Finally, knowing the criteria for deductible expenses is key. You can only deduct expenses that are necessary and related to property operation. This includes repair costs and insurance. The IRS is strict here, so maintain detailed and correct records of all expenses.

Foreign real estate investments come with unique opportunities and challenges. A firm grasp of deductions, credits, and treaties can significantly benefit you. Every deduction and credit helps lessen your tax load, making your investment more profitable. Always review current regulations or consult a professional for the best advice and practice.

How Can Expatriates Effectively Plan Their Real Estate Taxes?

Expatriates with foreign property face unique tax challenges. The US may tax Americans on all income, including from overseas property. You might be wondering, "Do I have to pay US taxes on foreign property?" The answer is yes. Income from foreign real estate must be included in your US tax returns. This includes rental income or gains from selling the property.

To plan effectively, start by knowing the reporting and compliance requirements for your international real estate. Every year, you must report foreign income. This could prevent costly penalties. The IRS has specific forms to file, so make sure you get it right.

Finding the right strategies for expatriate tax planning is crucial. A tax-efficient plan might include using deductions for mortgage interest or local property taxes. Some countries have tax treaties with the US. These can help reduce double taxation and make your taxes easier to handle.

You can use tools like a tax calculator for foreign real estate. These help you understand your tax obligations better. They consider various scenarios, so you know what to expect. But remember, these tools are guides, not the final word. Always verify numbers or assumptions against your specific situation.

It's smart to get professional help when dealing with complex international taxes. An experienced accountant can point out tax-saving opportunities and ensure compliance. Their guidance can be invaluable, especially when handling multiple jurisdictions' rules.

Finally, keep an eye on your foreign estate's impact on US taxes. Expatriates may face additional taxes like the Net Investment Income Tax. Preparing for these and understanding their implications can save you money and stress.

In conclusion, planning your real estate taxes as an expatriate involves understanding obligations, using strategic tools, and considering professional advice. With careful attention to detail and proactive measures, expatriates can navigate these waters effectively.

Conclusion

Navigating foreign real estate taxes requires careful planning and knowledge. We've explored types of taxes, capital gains tax impacts, and rental income guidelines. Understanding your residential status and using tax credits can help reduce liabilities. Always report sales and rental income accurately to avoid penalties. Use tools and seek expert advice for effective expat tax planning. By integrating these insights, you can handle global property taxes and make sound financial decisions as an expatriate. Stay informed and proactive to optimize your tax situation while living abroad.