TL;DR:

- Key tax deadline for expats to file is April 15; automatic extension to June 15 for those abroad.

- Payment due April 15 to avoid interest; further filing extension to October 15 is possible but doesn’t extend payment time.

- IRS penalties for late filing can add 5% monthly to your bill, up to 25%.

- IRS pursues unpaid taxes regardless of residence, potentially affecting credit, refunds, or property.

- U.S. citizens must report global income; keep thorough records and adhere to tax dates.

- Recent updates to expat tax laws exist; staying informed is critical.

- Consult a tax advisor specialized in expat needs to prevent costly errors and IRS issues.

Are you navigating the choppy waters of expat tax deadlines? It can feel overwhelming! I’ve been there, grappling with the web of U.S. tax laws while living abroad. In “Expat Tax Deadlines and Penalties: What Should You Know?”, we explore essential deadlines and potential pitfalls, ensuring you aren’t caught off guard. Learn about penalties and strategies that help you manage your obligations seamlessly. Let’s dive in and keep those tax woes at bay!

What are the Key Tax Deadlines for Expats?

As an expat, understanding your tax deadlines is very important. You might wonder, “What is the tax deadline for expats?” The main date to remember is April 15. However, if you live outside the U.S., you get an automatic extension to June 15. This gives you extra time to organize your paperwork and file your taxes.

But does that mean you have plenty of time to relax? Not quite. Even with the extension, any tax owed is due by April 15 to avoid interest. You can also apply for an additional extension to October 15 if needed. But remember, this extension gives you more time to file, not to pay.

Sometimes, expats ask, “How long do expats have to file taxes?” You generally have until June 15, with the option to extend to October. Make sure to request the extension before June 15. Proactively tracking these deadlines ensures you won’t face any surprises.

The IRS has specific guidelines for Americans living abroad. These include deadlines and forms that might be unfamiliar to you. Each year, tax laws might change, affecting deadlines. That is why the U.S. expat tax guide can be very useful. It has clear explanations on forms, deadlines, and the amounts you may need to pay.

Missing deadlines can lead to fines and added stress. Knowing the key dates helps you plan better. You will avoid penalties and the headache of dealing with IRS issues. Start the tax filing process early, keep track of all paperwork, and consult with a tax advisor specialized in expat needs. This way, you stay ahead of deadlines. Remember, the earlier you start, the less pressure you will feel. Stay informed and organized, and ensure you meet all required deadlines.

What Penalties Do Expats Face for Missing Tax Deadlines?

You might wonder, “What happens if I don’t pay taxes as an expat?” Failing to pay taxes can mean serious trouble. Expats face fines for missing tax deadlines. The IRS can charge you more than you owe initially. Late filing penalties will add to your tax bill. The extra charges can be five percent per month. If you keep delaying, it gets worse until it reaches 25%.

Now, you may ask, “Does the IRS go after expats?” Yes, the IRS will find you. They have methods to catch unpaid taxes, even overseas. They can freeze your accounts in the U.S. or overseas. It is not easy to hide from the IRS, no matter where you live.

The IRS can cause lots of problems if you miss paying taxes. You can lose refunds, or worse, have property taken. Not paying on time can also hurt your credit. This may make life hard when you need loans or even jobs.

If you ignore your tax duties, the impact can last many years. The IRS charges means you owe more money every day you delay. How can you avoid these problems? File on time, of course. Try to plan and set reminders for tax deadlines. Use a calendar to mark the tax dates each year. Talk to a tax pro if you feel lost or unsure. They can help save you from costly errors.

Keep records of your income, no matter where it is from. Even small amounts count toward taxes. If you stay organized, there’s less stress and fewer chances for mistakes. Knowing the penalties helps you avoid bad surprises. Take action now and protect yourself from tax penalties later.

How Can Expats Manage Their Tax Obligations and Avoid Penalties?

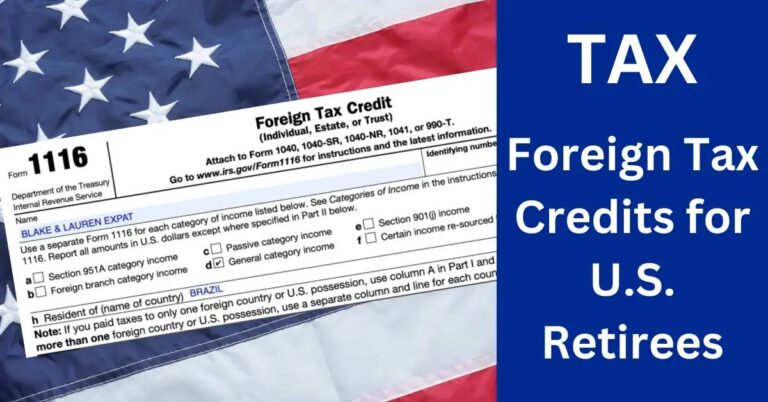

Why do you have to pay U.S. taxes if you live abroad? As a U.S. citizen, you must pay taxes on your global income, no matter where you live. This is due to U.S. tax laws that follow citizens globally. It can be puzzling, but satisfying these rules is essential for international tax compliance and avoiding financial penalties.

To effectively manage your expat tax obligations, start with keeping thorough records. Know what’s required and gather all documents needed for tax forms. One tip is to create a checklist of important tax dates and needed paperwork, so you don’t miss anything vital.

Avoiding expat tax penalties is crucial and requires careful planning. Firstly, file your taxes on time; late submissions often lead to fines. An extension on the U.S. tax deadline gives expats more time, usually until October. However, if you owe taxes, make payments by April to dodge interest fees.

Understand the U.S. tax deadline extension options if you need more time to file. Expats often get an automatic two-month extension to June. But remember, you must file by April if you owe any tax. Be proactive; consider hiring a tax expert to stay informed about any changes or updates.

There are recent updates and changes to the expat tax laws for 2024, so stay up to date. The rules are always changing, and knowing these updates helps in assessing your situation correctly. Check with IRS announcements or trusted news sources to ensure you’re not lagging in any aspects.

Thus, making a financial plan can help manage your tax duties and save energy and money. With the right information and approach, expats can meet their tax obligations and avoid penalties. Balancing financial tasks while living abroad requires a clear understanding of your rights and responsibilities.

Conclusion

Understanding U.S. expat tax deadlines and penalties is crucial. Meeting these deadlines helps you avoid costly penalties and stress. By knowing tax rules and extensions, you stay compliant and focused on enjoying your expat life. Remember, proper planning and knowledge keep you ahead. Don’t let taxes ruin your adventure; stay informed and prepared.