TL;DR:

- Retired expats generally must pay U.S. taxes, including on Social Security and pensions.

- They must file U.S. taxes annually if income exceeds a threshold; this includes foreign earnings.

- Tax treaties can prevent double taxation; expats should research relevant agreements.

- FBAR filing is required for foreign accounts over $10,000, and FATCA compliance is crucial.

- Key tax deadlines are April 15, or June 15 if abroad; extensions can push this to October 15.

- Expat tax strategies include using the Foreign Earned Income Exclusion and Foreign Tax Credits.

- Hiring a tax professional is recommended for strategy and compliance.

- Keeping organized financial and tax documents eases the filing process.

Filing taxes as a retired expat can feel overwhelming, but I've got you covered. Dive into this guide and learn how to meet U.S. tax requirements while enjoying life abroad. We'll explore everything from filing status to using expat tax treaties. Plus, I'll share tips on e-filing and claiming tax credits. Let's simplify this taxing task and put your tax worries behind you. Ready to demystify those tax obligations? Let’s begin!

Understanding Tax Requirements for Retired Expats

Do retired expats have to pay US taxes? Yes, they often need to. If you retire abroad, your income might still be subject to U.S. taxes. The IRS requires citizens to file taxes regardless of where they live. This includes Social Security and pensions, which often count as taxable income.

Identifying your tax filing status is important. Your marital status and yearly income determine your filing status. Find out if you qualify for head of household or single status. This affects your IRS tax obligations.

Does this mean you must file taxes as an expat? Yes, usually. You must file annually if you make over a certain amount. This includes any money earned abroad and Social Security income. Ensure you meet the IRS tax regulations for retirees overseas.

Your residency can impact tax requirements. Where you live and your visa type may change your tax situation. Some countries have agreements with the U.S. to avoid double taxation. Research tax treaties between the U.S. and your new home country. This might ease double tax liabilities for you.

Tax treaties play a role in deciding tax payments. These agreements prevent you from paying taxes in both countries. They determine how much tax you pay to each country. Check if your country has a tax treaty with the U.S. before filing. This helps you manage tax responsibilities and saves you money.

You will need common tax documents to file taxes. Keep wage slips, Social Security statements, and pension receipts. You may need proof of foreign taxes paid, like receipts or bank statements. With these documents, you simplify tax filing and comply with requirements.

What Are Expat Tax Obligations?

Even if you live abroad, the U.S. expects you to file taxes. This is because of citizenship-based taxation. It means U.S. citizens pay taxes no matter where they live. So, if you're an expat, you must keep up with your tax reporting obligations.

You might wonder, "Why do I have to pay U.S. taxes if I live abroad?" The answer is simple: the IRS wants everyone to chip in, even if they live far from home. If you earn money overseas, you have to tell the IRS about it. This includes money made from jobs, pensions, or investments.

Not filing your taxes can lead to penalties for late tax filings. If you don't report on time, you pay extra. Sometimes the IRS also charges interest on what you owe. So, don't ignore it; file your taxes on time.

Another important task is reporting foreign bank accounts. You must file an FBAR if you have more than $10,000 in overseas accounts at any time during the year. It's like telling the IRS about your piggy bank in another country.

You may also hear about FATCA, or the Foreign Account Tax Compliance Act. This law helps the IRS find out about your foreign accounts. Your bank might already share info about you with the IRS because of FATCA compliance.

Does the IRS go after expats if they don't file? Yes, they do. The IRS will find you and ask you to pay. They also work with other countries to share tax info. So, it's better to stay on top of your taxes. Stick to the rules and the IRS will stay happy.

Are you ready to tackle your tax obligations? Great! Keep organized and make sure to meet each deadline. Your peace of mind is worth the effort.

How to File Taxes as a Retired Expat

To file U.S. taxes from abroad, follow these steps. First, gather your tax documents. You need forms like W-2, 1099, and any reports on retirement income. Next, choose the right expat tax software. Look for software that handles foreign income with ease.

Use e-filing options to send your tax return to the IRS. E-filing makes it fast and reduces errors. There are online services for expats that can help you e-file from any country. They guide you through the process and ensure accuracy.

Apply the Foreign Earned Income Exclusion if you still earn income abroad. This exclusion allows you to avoid double taxation by reducing your taxable income. Check if you qualify by meeting the physical presence or bona fide residence test.

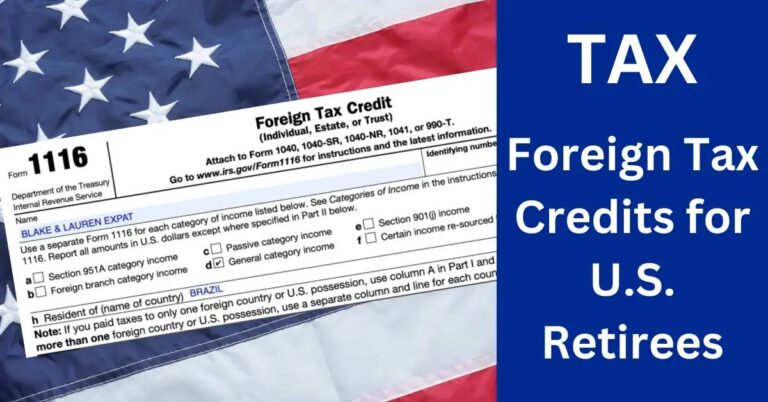

Another option is to claim the Foreign Tax Credit. If you pay taxes to another country, this credit helps prevent double taxation. You can subtract what you paid abroad from your U.S. taxes.

Understand the unique challenges of retiring abroad and how tax treaties may apply. These treaties help prevent being taxed twice on the same income. Learn which treaty applies to your country if one exists.

Finally, consider hiring a tax professional who knows expat taxes. They can advise on both compliance and saving strategies.

Filing taxes as a retired expat involves extra steps, but you can handle it. By using the right software, e-filing, and understanding exclusions and credits, you make the process smooth. Stay informed about U.S. tax laws and enjoy your retirement abroad.

Do Retired Expats Pay Taxes in Both Countries?

Retired expats might worry about paying taxes twice. So, do expats pay taxes in both countries? Usually, but not always. You might pay tax in both your host country and the U.S., but double taxation agreements help. These agreements let you avoid paying taxes fully in both places. They are treaties between countries to make sure you are taxed fairly. Check if your new country has one with the U.S.

Double taxation agreements work by giving tax credits. If you pay tax in your new country, you might get a credit when filing U.S. taxes. Keep records when you pay taxes to foreign governments, like receipts and statements. This proof helps when you report and claim these credits.

It's important to know local tax laws. Different countries have unique rules. Understanding them helps you avoid fines or penalties. You might need to hire a local tax expert. They can guide you through the process and ensure you follow the laws.

Dual citizenship also affects taxes. If you’re a citizen of two countries, you have tax implications. You need to consider the tax obligations in both places. Sometimes, dual citizens have to file returns in each country. Knowing how your status affects your taxes makes a big difference.

There are strategies to minimize dual tax liabilities. Plan your tax moves carefully. You can arrange your finances to lower your tax bill. Some expats move their investments. Others adjust their income sources. A tax advisor can help with these strategies.

In your planning, also consider tax credits and exclusions. The Foreign Tax Credit helps reduce your U.S. tax bill for taxes paid abroad. Using it correctly can save you money. Understanding these points will ease your tax filing and save you stress.

Are There Tax Benefits or Exemptions for Retired Expats?

As a retired expat, you might wonder about tax benefits available to you. The first thing to explore is the tax deductions for retirees living abroad. These can significantly reduce your tax bill. For instance, you may qualify for the Foreign Earned Income Exclusion or the Foreign Tax Credit if you still earn some income abroad.

Exploring the idea of expat tax exemptions can lead you to countries with favorable tax systems for retirees. Some countries allow retirees to pay little to no taxes on retirement income. You might find it beneficial to look for countries offering full or partial tax exemptions on retirement benefits.

One of the best ways to reduce your tax bill as a U.S. citizen living abroad is by utilizing U.S. tax treaties. These treaties often help you avoid double taxation. They define what taxes you owe to each country and ensure you do not pay more than necessary. Check specific treaty benefits, as they vary by country.

Are you wondering about claiming dependency exemptions as an expat? If you have dependents, you might still be able to claim exemptions on your U.S. taxes. The Internal Revenue Service allows you to claim children or relatives if they meet specific requirements, even while living abroad.

Consider your contributions to charity as well. Retirees often give back, and charitable contributions tax benefits are available to you. Donations to U.S.-based qualified charitable organizations might provide you with additional deductions on your U.S. taxes, lowering your tax payable.

Taking full advantage of these benefits and exemptions can simplify your financial situation as a retired expat. Understanding your options and using these strategies can help you keep more money in your pocket while you enjoy your golden years abroad. With this knowledge, you can make informed decisions that benefit your fiscal health.

When Are the Tax Deadlines for Retired Expats?

Filing taxes on time helps you avoid penalties and interest charges. Every expat should remember a few key tax deadlines. Here’s how to file taxes without delays:

Key Tax Deadlines:

For retired expats, the regular IRS deadline is April 15. However, if you live abroad, the deadline stretches to June 15. Keep this date in mind, as it gives you more time to prepare and file.

Applying for Filing Extensions:

If meeting the June deadline is tough, apply for an extension. Form 4868 gives you until October 15. It's essential to submit this form before the original deadline, ensuring you do not miss it.

Addressing Missed Deadlines:

Have you missed the tax deadline? File as soon as possible to reduce added penalties. The IRS may offer relief in some cases if you file late with a good reason. Explain your delay and provide evidence of your situation.

Filing Jointly as Expats:

Filing with your spouse might benefit you. Joint returns could mean lower tax rates or qualifying for higher deductions. Both partners need to agree, so ensure clear communication about finances.

Tips for Timely Global Tax Compliance:

Organize your financial documents early. Keep everything in one place to speed up the process. Staying informed about local tax laws helps avoid surprises. Use a checklist to track what’s done and what still needs attention.

Timely filing saves stress. Remember, taxes are an annual task. With these tips and understanding deadlines, you can stay on top of your tax duties.

How to Plan and Strategize for Expat Taxes?

Planning taxes as an expat takes time and thinking. First, regular expat tax planning is crucial. This keeps you in line with tax rules. It also helps you save money. Planning helps you know what you owe and how to pay less.

You must use solid tax strategies for expats. Consider tax deferral strategies. These let you pay taxes on future income later. Use plans like IRAs or 401(k)s, but only if they suit your situation. These can grow your savings while keeping some tax benefits.

Work with expat tax advisors to get the best results. They know complex tax rules and can help you better than tax software. They help ensure you take every legal step to save money and avoid penalties. A good advisor can point you to the best expat tax planning tips for your situation.

Keeping tax records organized is also vital. Store all income and expense proofs. Sort documents by year and type. Know what the IRS needs, such as Form 1040. This can help if the IRS asks questions later.

Consider global retirement savings plans carefully. Not all plans work well with U.S. tax policies. You must check if your employer's retirement plan is recognized by the U.S. tax system. The right plan can bring tax-free growth or tax-deferred growth.

So, how can you ensure compliance and savings? Understand your tax position, explore tax deferral strategies, and seek professional advice. Keep your records neat and in one place. These steps can make sure you meet U.S. tax rules without paying too much. Planning helps you keep your money where it belongs—growing in your hands.

Conclusion

Understanding tax requirements for retired expats involves more than checking a single box. You need to know your U.S. tax obligations and filing status and grasp how residency impacts taxes. Tax treaties can help avoid double taxation. Remember, being abroad doesn't change your need to comply with IRS rules. Proper planning and using tools like expat tax software can streamline the process. Tax planning helps navigate complexities and maximize benefits, so always be proactive. Staying informed empowers you to handle your taxes confidently and focus more on enjoying your life abroad.