TL;DR:

- A Foreign Tax Credit (FTC) prevents double taxation for U.S. retirees abroad.

- U.S. citizens can claim FTC if foreign taxes are non-refundable and a real cost.

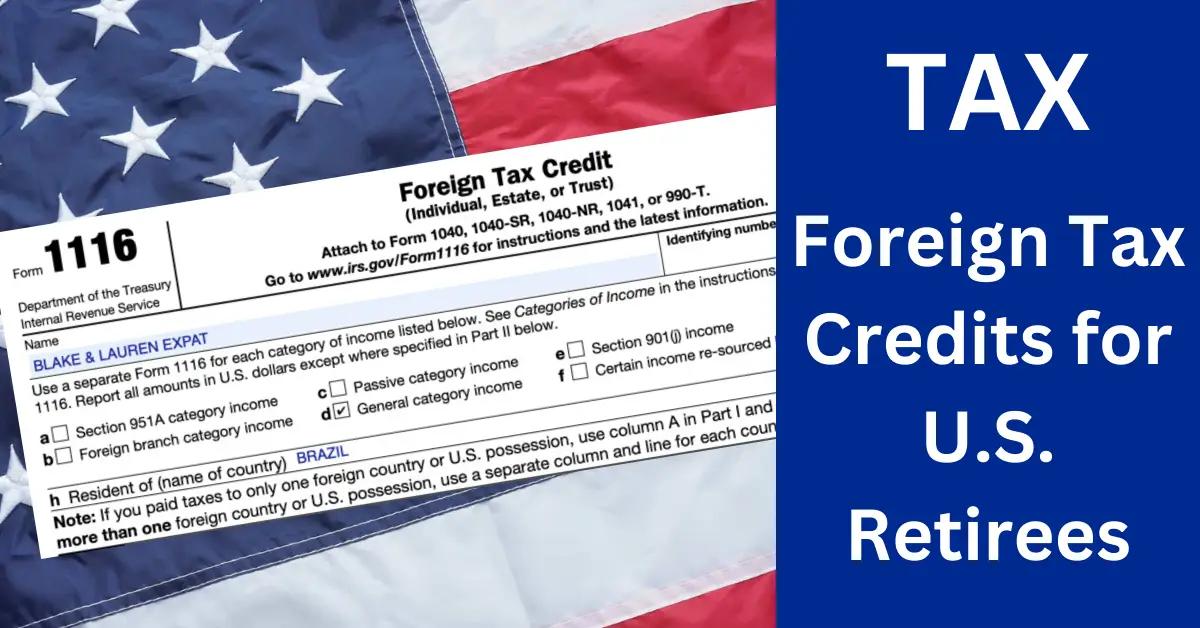

- Proof of foreign tax payments and IRS Form 1116 are needed for claiming FTC.

- Some income isn't eligible for FTC, including local sales/property taxes.

- Plan retirement locations considering favorable tax treaties and laws.

- Tax treaties prevent dual taxation and detail which income the U.S. can tax.

- U.S. retirees living overseas must pay taxes on global income.

- Filing requires IRS compliance using forms like 1116 and 8833.

- Stay informed on tax laws; missteps can have costly penalties.

- Use tax credits and treaties strategically to maximize tax benefits abroad.

Navigating taxes abroad can be tricky for U.S. retirees. Did you know there's a way to avoid double taxation? It’s called the Foreign Tax Credit (FTC). This credit might help you pay less on your U.S. taxes while living in another country. But how do you qualify for it? Let me guide you through the process. We'll explore eligibility, common hurdles, and necessary documents to make tax season less of a hassle. Dive in to discover if foreign tax credits are right for you!

What is a Foreign Tax Credit and How Can U.S. Retirees Abroad Become Eligible?

A foreign tax credit (FTC) helps prevent double taxation. If you are a U.S. retiree living abroad, this is very important. It allows you to claim a tax credit on foreign taxes paid. So, you pay less to the U.S. government.

Can a U.S. citizen claim a foreign tax credit? Yes. A U.S. citizen can claim this credit if they paid taxes abroad. You must earn foreign money and get taxed by that country. The credit is limited to the U.S. tax amount on your foreign income.

To be eligible, you need proof of foreign tax payments. Keep those records safe, as they help you to qualify for expat tax credits. If you want to qualify, the taxes you pay abroad should not be refundable. They need to be an actual cost to you.

Is there a tax credit for living outside the US? Yes. The foreign tax paid credit helps you with taxes from the U.S. The credit amount depends on your foreign tax and U.S. tax calculation.

But remember, qualifying for this credit can be tough. Not all taxes you paid abroad may count. Local sales taxes or property taxes do not qualify. Some treaties between the U.S. and other nations could affect your eligibility.

You will need key documents when filing for the FTC. These include the IRS Form 1116, proof of payment, and foreign tax return copies. Get these ready in advance, so you avoid delays or errors. Disorganization may cause you to miss tax benefits.

Finally, understanding the rules can seem tricky. Yet, taking time to learn will save you money. If unsure, consider speaking to a tax expert. They can help make sure you get all the credits you are eligible for. Knowledge of these credits protects your finances while living overseas.

How Can U.S. Retirees Maximize Their Tax Benefits While Living Overseas?

You might wonder, "Why pay U.S. taxes if I live abroad?" As a U.S. citizen, you must pay taxes on global income. The IRS requires it. But don't worry! There are ways to lessen this burden through tax benefits. One great option is using Foreign Tax Credits. These credits help against double taxation, a common issue for retirees abroad.

Dual taxation happens when two nations tax the same income. Imagine earning money in Spain and paying taxes there, only for the U.S. to demand more. Sounds unfair, right? This is where the Foreign Tax Credit comes in handy. It can offset the taxes you already paid abroad. As a result, you owe less here in the U.S.

To make the most of these benefits, plan strategically. Look for popular retirement spots with friendly tax laws. Places like Portugal or Mexico often feature in discussions. These countries have attractive tax perks. For example, some offer reduced rates or tax-free periods for new residents. This can greatly enhance your financial well-being during retirement.

Tax treaties also play a key role. Treaties between the U.S. and other countries prevent double taxation. They can improve your tax situation by offering credits or deductions. Learn about the treaties your chosen country has with the U.S. It may lead to big savings and a comfier retirement.

If you want to explore more strategies, consult the U.S. retiree abroad tax guide. It will give good insights into legal ways to reduce tax liabilities. Remember, careful planning and smart choices shape great retirement.

Dive into the details, study the agreements, and choose a country that fits your needs. Always stay informed, and consult a tax expert when necessary. These steps can help maximize your tax benefits while you enjoy your time abroad.

What Role Do Tax Treaties Play in Retirement Abroad?

Tax treaties help U.S. retirees live happily overseas. They prevent paying taxes twice on the same income. This happens because both the U.S. and the country you live in may want to tax your income.

Is there a tax credit for living outside the U.S.? Yes, tax treaties and foreign tax credits work together to help you avoid extra taxes.

A tax treaty is like a special agreement. It sets how much tax each country can take. This keeps your hard-earned money safe.

Let's talk about double taxation avoidance. Tax treaties help you pay taxes to only one country. The country where you live usually gets to tax you first. The U.S. has treaties with many countries where retirees like to settle. Countries such as Mexico, Canada, and Portugal are examples.

Do I have to pay U.S. taxes if I retire overseas? Yes, but you can ease the burden through tax treaties and credits.

Here's how to apply tax treaty benefits to your income. First, check if there's a treaty between the U.S. and your new country. The IRS website has this information. Next, understand the specific terms. Some income might be free from U.S. tax. See if your pension or social security falls under this.

Then, report your income on your U.S. tax return. Use Form 8833, Treaty-Based Return Position Disclosure. Follow the form's instructions carefully. You may need help from a tax expert.

More retirees settle in countries with tax treaties for retirees for this reason. The agreements keep financial stress low. Each country has its own rules, so study them well.

Understanding tax treaties and their benefits can save you money. It helps you plan better, making retirement abroad pleasant.

How Should U.S. Retirees Plan for Filing Taxes from Abroad?

Filing taxes from abroad can feel daunting for U.S. retirees. The key is to understand the filing requirements. Here’s what you need to know. First, ask yourself, Do I have to pay U.S. taxes if I retire overseas? Yes, you do. Even if you live abroad, you must file a U.S. tax return.

You must report all earned and unearned income, including social security benefits and pensions. U.S. expat tax planning helps ensure you meet these obligations. Keep an eye on tax filing deadlines for expats. Missing these can lead to penalties. Usually, expatriates have until June 15 to file, but payments should be made by April 15 to avoid interest.

A valuable tool you’ll need is IRS Form 1116. This form is crucial for claiming the Foreign Tax Credit. The credit can lower your U.S. tax by the amount you’ve already paid to another country. However, completing Form 1116 requires care. Seek help to avoid common mistakes. A common blunder is misunderstanding the foreign tax credit limit. Knowing that limit helps you claim only what is allowed.

Here’s a foreign tax credit example: Suppose you paid $1,000 in foreign taxes on pension income. Through Form 1116, you could reduce your U.S. taxes by that amount, but only against income taxed in both countries. Be precise to ensure accuracy.

Tax filing for expatriates often involves complex guidelines. External resources can help simplify this. You might consider using specialized tax software designed for expatriates. These tools can guide you through every step. They help ensure you don't overlook any necessary details. Retirees abroad can also use guides that outline U.S. filing requirements in simple terms. You could use resources like the IRS website, which provides updated information.

Planning ahead makes tax filing manageable, ensuring compliance and optimizing your benefits while living abroad.

Why is Understanding Tax Obligations Crucial for Retirees Abroad?

"Do I have to pay U.S. taxes if I retire overseas?" The answer is yes. As a U.S. citizen, you have to pay taxes on your worldwide income, no matter where you live. This includes pensions, savings, and any other foreign income. You might wonder, "Why do I have to pay U.S. taxes if I live abroad?" It is because your U.S. citizenship comes with global tax obligations. The U.S. is one of the few countries requiring this.

Let's break down these tax obligations. Suppose you have a foreign pension. The IRS sees it as income. You must report and pay taxes on it. It’s essential to understand how this impacts your finances. If you miss reporting this, you might face penalties.

Many new expatriates are shocked by this policy. Take Jane, for example. She retired to Italy, thinking her pension would stretch further. She didn’t realize she had U.S. tax liabilities. Jane ended up owing a huge amount because she failed to file. Not being aware or filing late can be costly.

Another key point is how tax laws can change. The U.S. tax code frequently updates, which can impact you. Changes might increase or reduce your tax bill. Staying informed is crucial. You can use resources like the IRS website to keep updated.

Understanding these obligations helps you avoid surprises. It ensures you maintain good standing with the IRS. You will feel more secure knowing you comply with tax laws. Applying this knowledge helps you enjoy your retirement without financial worries.

Remember, being proactive is far better than reacting to unexpected tax bills. By informing yourself, you can steer clear of potential pitfalls. When settling in a new country for retirement, knowing your tax obligations is as important as choosing your new home.

How Can U.S. Retirees Claim Foreign Taxes Effectively?

Claiming foreign taxes can reduce double taxation for retirees living abroad. The process begins with identifying the eligible foreign taxes you've paid. Understand what counts towards the foreign tax credit. Your taxes should be an income tax or an equivalent tax to qualify.

To claim foreign tax credits, start by calculating them carefully. Use IRS Form 1116 to report eligible taxes. This limits your credit to the U.S. tax that would be due on the same income. To maximize credits, ensure your calculations are accurate. Be aware of currency exchanges and tax rates to avoid mistakes.

A common question is, "Is there a foreign tax credit limit?" Yes, there is. The credit cannot be higher than the U.S. tax owed on the same income.

Preparing forms and documentation is key. Gather proof of taxes paid, like receipts or bank statements. Keep organized records to support your claims. This makes the process smoother and reduces errors.

Suppose you're using the foreign earned income exclusion. In that case, you might not claim credits for income excluded under it. The exclusion lets you avoid some U.S. taxes on foreign income. However, it works differently than credits and doesn't reduce U.S. taxes on pensions.

Knowing these rules can help get credits effectively. It saves money and prevents mistakes. Follow IRS guidelines and stay updated on changes. Ignoring details or poor records can lead to audits or missed savings. A tax advisor can offer tailored advice for your situation.

For more specific advice, consider reviewing the IRS guidelines on foreign tax credits. This resource offers in-depth instructions and updates.

What Strategies Can U.S. Retirees Use to Optimize Taxes Abroad?

"How much overseas income is exempt from US taxes?" is a question many retirees ask. The quick answer is that the Foreign Earned Income Exclusion (FEIE) lets you exclude up to $108,700 of your foreign-earned income if you qualify. This applies if you have a tax home in a foreign country and meet the bona fide residence or physical presence test. However, retirement income doesn't qualify as earned income, so it's not covered by the FEIE. But there are still ways to legally reduce your tax liability while living abroad.

One way to cut down on taxes is to make sure you know all about tax treaties between countries. These treaties can help prevent double taxation. For instance, if your home country has a tax treaty with the U.S., you might avoid taxes on certain retirement income. This method demands research, as the rules differ from country to country. Being informed is key.

Planning your investments smartly is another strategy. You should find out where to hold your money for the best tax efficiency. For instance, income from dividends or interest might be taxed less in certain countries. Understanding the tax rates on your investment types can save you a lot.

Sustainable withdrawal strategies can also minimize taxes. By strategically taking out retirement funds, you can stay within lower tax brackets. Plan withdrawals to avoid large tax jumps in any single year. This approach ensures that you spread tax payments over time, managing your annual tax liability more effectively.

Using both retirement and investment income well is essential. Mix and shuffle different income types to optimize your tax position yearly. Balance between taxed and tax-free accounts, and always consult with a tax advisor who's savvy about international laws. It is crucial because small differences can greatly affect your pocketbook.

Conclusion

Living abroad as a U.S. retiree requires smart tax planning. We've explored how to claim foreign tax credits, avoid dual taxation, and utilize tax treaties. Understanding these areas helps you maximize savings and minimize tax liabilities. Ensure you're filing correctly with necessary documents like Form 1116. Stay updated on tax laws and use the strategies discussed. Planning well and understanding your obligations will let you enjoy retirement without tax worries.